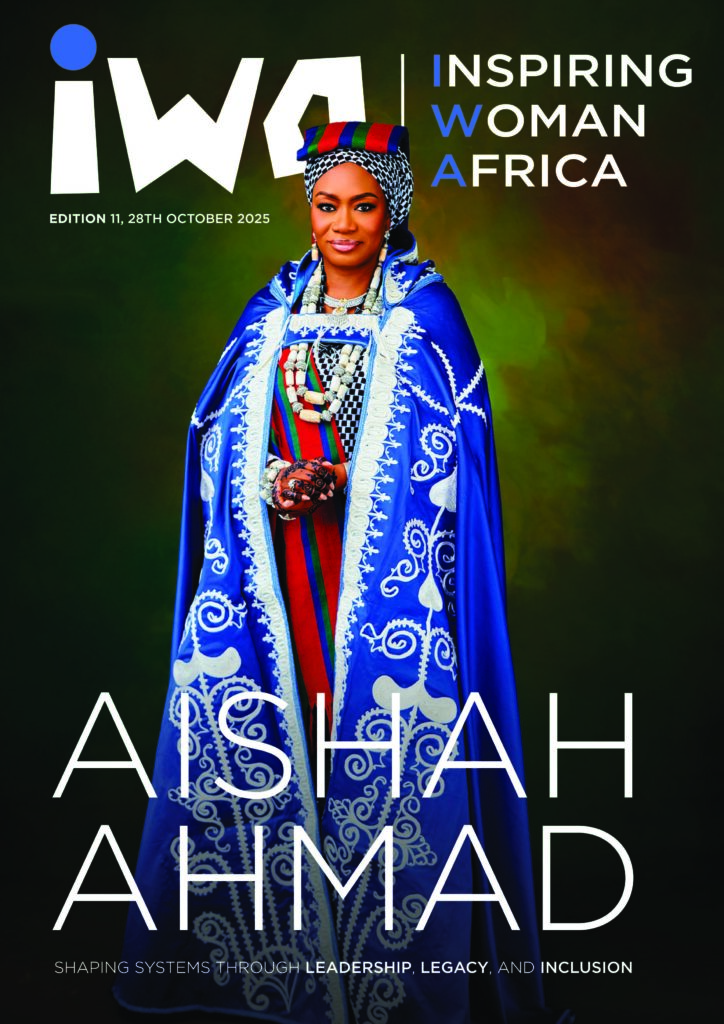

Aishah Ahmad

A trailblazer, her name is written indelibly in Nigeria’s history as the first female Deputy Governor for Financial System Stability at the Central Bank of Nigeria, serving from 2018 to 2023. In that role, she shepherded landmark reforms — including the enactment of the banks and Other Financial Institutions Act. She steered Nigeria’s financial system with courage through the turbulence of the COVID-19 pandemic, ensuring resilience while fostering record growth in digital transactions and credit to the real economy.

Aishah’s work in financial inclusion has left a lasting legacy. By pioneering Nigeria’s first International Financial Inclusion Conference and mobilising a national coalition, she achieved the highest recorded increase in access — lifting financial inclusion by 11 percentage points to 74%. For this and more, she has been recognised on the global stage, addressing world leaders at the IMF–World Bank Annual Meetings, Harvard Kennedy School, and the University of Oxford.

Her service extends far beyond regulation. She has chaired critical national institutions and projects, including the Nigeria Interbank Settlement System and the National Arts Theatre Renovation. Today, she serves on global boards such as the Financial Alliance for Women and SOS Children’s Villages International, where she was chairperson in Nigeria. She also contributed to the work of the Islamic Financial Services Board (IFSB).

She earned degrees in Accounting from the University of Abuja (Second Class Upper), an MBA in Finance from the University of Lagos, and a Master’s in Finance and Management from Cranfield School of Management in the United Kingdom. She is also a Chartered Financial Analyst (CFA), a Chartered Alternative Investment Analyst (CAIA), and a Fellow of the Chartered Institute of Bankers of Nigeria.

Her commitment to gender equity is deeply personal and widely impactful. She institutionalised women’s leadership as a priority at the Central Bank, hosting events annually, directly mentored more than 600 female policymakers and helped ensure an unprecedented rise of female chief executives in Nigeria’s banks. Through WIMBIZ’s Big Sister Programme, she has touched the lives of thousands of young girls across Nigeria.

Aishah has also brought development home to Niger State: securing hostels, water systems, and other infrastructure for schools; revitalising the Gbobbi Game Reserve; and supporting farmers with agricultural finance.

She continues to bridge finance, governance and advocacy and remains a tireless champion of inclusion, equity, and empowerment, through her work as Founder of LMFI Group, Bridgforte and the Amfani Zhiba Foundation.

For a lifetime of integrity, service, and transformative leadership, Aishah Ndanusa Ahmad was conferred with the traditional title of Soniya Asusu Nupe — an honour that affirms her place as a treasured pillar of the Nupe Kingdom, custodian of heritage, and beacon of prosperity for Niger State and for Nigeria.

What inspired you to pursue a career in finance, and were there any pivotal moments that shaped your path?

I watched my mother become a Chartered Accountant after studying Pharmacy up to postgraduate level — that was my first foray into numbers. My first love was marketing or something more creative, but she encouraged me to pursue what she called a “professional qualification,” which led me to accounting and, eventually, to finance.

From a young age, I was fascinated by the power of finance to transform lives and societies. Growing up in Nigeria, I saw how access to capital could determine whether a business survived or failed, and how financial systems shaped opportunity.

My investment management and private banking career taught me how wealth is created, multiplied, and preserved across generations. Later, through leadership roles in retail and consumer banking, I saw how innovative financial products could bring dignity and possibility to people’s lives. These experiences convinced me that finance, when structured properly, isn’t about numbers; it’s about people and empowerment.

How did your educational and professional experiences shape your leadership philosophy in the financial sector?

Each stage of my education added a new lens to leadership. My accounting degree from the University of Abuja built a strong technical foundation, discipline and resourcefulness. My MBA in Finance from the University of Lagos taught strategy and management and deepened my understanding of global finance. My MSc in Finance & Management from Cranfield University in the UK exposed me to best practices in venture capital and alternative investments.

That experience also encouraged me to pursue professional qualifications such as the Chartered Financial Analyst (CFA) and Chartered Alternative Investment Analyst (CAIA) designations. These deepened my analytical discipline and broadened my global perspective.

Equally important were mentors and colleagues who believed in me and taught resilience, strategic leadership, and humility. These lessons shaped my leadership philosophy: apply rigour to decisions, empathy to people, and integrity, professionalism to every context.

As the first female Deputy Governor for Financial System Stability at the Central Bank of Nigeria, what were the biggest challenges you faced — and what did they teach you about leadership?

Breaking new ground brings both opportunity and pressure. Beyond the technical demands of safeguarding financial system stability in a fast-evolving economy like Nigeria and navigating the COVID-19 pandemic, there was the weight of representation and hyper-visibility — knowing that how I performed could either widen or narrow the door for other women.

There was no playbook. I was only the second woman ever appointed Deputy Governor, and the first to oversee the critical stability portfolio. I had to chart my own course — balancing reform with resilience in a highly politicised environment. Those years taught me that leadership demands clarity of purpose, calm under pressure, and the courage to act with conviction even amid uncertainty.

Serving at the Central Bank remains one of the most defining honours of my career. I’m deeply proud of the work we did to strengthen the regulatory framework through the Banks and Other Financial Institutions Act (BOFIA) and to drive market and regulatory innovation — from Open Banking and the establishment of Payment Service Banks to the launch of the AfriGo domestic card scheme. We also promoted greater industry competition through new license issuances and created an enabling environment for the growth of agent networks and gender-focused financial solutions — reforms that helped position Nigeria as one of Africa’s most dynamic financial and payments hubs.

Equally important, I made it a priority to champion women’s leadership — ensuring greater female representation within the CBN and at the helm of banks and financial institutions across the country. For me, leadership has always been about using one’s position in service of others.

Nigeria made remarkable progress on financial inclusion during your tenure, growing to a historic 74%. What key strategies made the biggest difference?

We recognised early that financial inclusion was not just a banking concern — it was a national development imperative. Through regulatory innovation at the Central Bank and the coordinated work of the National Financial Inclusion Steering and Technical Committees, we drove reforms that combined policy, innovation, and partnership.

Key initiatives included expanding agent banking to underserved communities — from rural villages to cattle markets — and enhancing financial literacy through targeted capability programmes and the SabiMoney portal, which equipped millions with practical tools for managing their finances. We also established state-level financial inclusion coordinators to localise implementation and track progress more effectively.

Crucially, reforms such as the Women’s Financial Inclusion Dashboard, tiered KYC, and the push for digital financial services ensured that inclusion reached those who had been historically excluded. I was proud to curate the International Financial Inclusion Conference (IFIC), which became a global platform to showcase Nigeria’s achievements, exchange lessons, and connect innovation to policy.

Together, these efforts demonstrated how public-private collaboration, anchored on shared purpose, can deliver measurable and lasting impact.

You have long championed women’s leadership and inclusion. What proven strategies work best — and what advice would you give young women entering finance today?

Intentionality matters. Quotas introduced by the CBN in 2013 for female representation in executive management and on boards of financial institutions laid a strong foundation for the progress we see today.

But policies alone are not enough; we need sponsorship, visibility, and fairness in hiring and promotions. Structured mentorship programmes, when paired with clear metrics for inclusion, change outcomes. At the Central Bank, deliberate gender empowerment policies helped more women advance into leadership roles within and across financial institutions. Outside the Bank, networks such as WIMBIZ have built invaluable ecosystems of visibility, mentorship, and leadership development.

My advice to young women: believe you belong, build competence relentlessly, and seek sponsors early who will speak for you when you’re not in the room. Above all, stay anchored in purpose — that’s what carries you through difficult seasons.

What inspired the creation of the Bridgforte Dialogues, and what lessons emerged from the inaugural launch at UNGA 80?

The Bridgforte Dialogues were born from the belief that inclusion and innovation cannot thrive in silos. Sustainable progress depends on unusual coalitions — regulators, innovators, investors, and citizens — engaging as partners. Bridgforte was envisioned as a bridge of fortitude: a platform for candid, cross-sector conversations that uncover the elephants in the room and turn insight into action.

Our inaugural roundtable at the Harvard Club, “Financial Inclusion Towards 2035: Shifting Power, Shaping Systems”, brought together central bank governors, fintech founders, philanthropists, and development leaders. The turnout and engagement were exceptional, surfacing new frontiers of inclusion: trust, literacy, infrastructure, co-designed products, and the need for systemic change. The strong follow-up commitments confirmed the appetite for sustained collaboration. Bridgforte is now evolving into an ecosystem – through the Inclusion Gap Map, Principles for the Next Chapter, and regional dialogues – to keep those conversations alive.

Your work (from policymaking to philanthropy) consistently centers on inclusion. What fuels this passion, and how has it evolved over time?

It comes from a personal place. For much of my life, I’ve navigated spaces where I didn’t quite fit the mould – by age, gender, or background. Those experiences taught me empathy for people whose voices are often overlooked, and a determination to make leadership more inclusive. Over the years, I’ve found deep joy in bringing people from the margins into the mainstream (women, the poor, the underrepresented, and the economically excluded) and in building systems that value their contributions.

This mission has guided every chapter of my life: expanding women’s networks through WIMBIZ, embedding inclusion in policy at the Central Bank, and through Soniya Asusu Nupe and the Amfani Zhiba Foundation, translating that vision into grassroots action. Today, through Bridgforte, that mission extends to the global stage. Inclusion isn’t just policy for me — it’s a life’s calling.

Your traditional title, Soniya Asusu Nupe, and your philanthropic work through the Amfani Zhiba Foundation both emphasise stewardship and service. How do they embody your broader mission of building inclusive prosperity?”

The title Soniya Asusu Nupe — meaning “Leader or Queen of Treasury” and “Custodian of the Commonwealth” — is an honour from the Nupe Kingdom recognising my contributions to finance and national development. It carries the responsibility of advising the Etsu Nupe on economic and social matters.

In our tradition, the Asusu safeguards the community’s wealth for the benefit of all — a reminder that prosperity has always been communal. That ancient principle mirrors the ethos of modern finance and philanthropy: wealth as a tool for collective good.

The Amfani Zhiba Foundation, launched at the conferment, reflects the same value. Amfani means “usefulness” and Zhiba means “gift.” Its mission is to turn potential into purpose — helping women and youth harness their gifts through mentorship, education, and enterprise.

For me, this title is more than symbolic. It is a call to service — to bridge tradition and modernity, finance and community, and to champion inclusive prosperity across the region and the African continent.

What do you see as the most pressing issues facing the financial system today?

Globally, rapid digitization and rising cyber risks demand constant vigilance, while climate change calls for more innovative and sustainable approaches to finance.

As artificial intelligence and advanced technologies reshape the industry, there is a real danger of widening exclusion: of leaving even more people behind as systems become more automated and data-driven. We must also confront the growing incidence of financial fraud, which erodes public trust, and urgently raise the overall level of financial and digital literacy among users.

For Nigeria, the priorities remain clear: deepening inclusion, stabilising foreign exchange markets, and rebuilding institutional trust. Addressing these challenges will require closer cooperation between regulators, innovators, and the private sector: crafting policies that safeguard stability while fostering innovation. Ultimately, the goal must always be the same: to ensure financial wellbeing for individuals and families, and shared prosperity for all.

Looking ahead, what’s next for you, and what gives you hope for the future of finance and governance in Nigeria?

This next chapter is one of reflection and renewal, a period to advise, teach, and convene, while continuing to help shape institutions that endure beyond individuals or political cycles. My focus remains on building systems that serve people — systems designed for resilience, fairness, and long-term impact.

What gives me hope is the energy of young Africans: their creativity, optimism, and refusal to accept limits. Across Nigeria and the continent, a new generation is redefining finance, governance, and leadership. The future will belong to societies that harness their ideas and trust them to lead.

If we stay anchored on integrity, innovation, and inclusion – and design institutions that empower rather than exclude – we can build a Nigeria, and an Africa, where opportunity is equitable and progress truly shared.

You recently celebrated your birthday. What are you grateful for?

Birthdays have become less about celebration and more about gratitude and perspective. I’m deeply thankful for the experiences (both joyful and difficult) that have shaped me into who I am today.

Challenges have a way of revealing what endures: faith, purpose, and the quiet strength that comes from trusting you’re exactly where you’re meant to be.

At this stage, I’m focused on purpose over pace, choosing projects that align with my values, nurturing the next generation, and investing time in the people and causes that truly matter. I’m thankful for those who have held space for me, for work that continues to stretch and inspire me, and for the privilege of another year to grow, serve, and impact others.